If I’m being reliable, I’ve always been first fee with money. I’m not sure if it’s the eldest daughter in me, my family’s immigrant background, or the number of events I look at Bundle Kittredge (positive, the American Girl) dwelling by the use of the Good Melancholy, nonetheless I’ve always been one to pinch a penny. As a baby, that meant saving as loads cash as I would in a literal piggy monetary establishment. As an grownup, it has translated to counting on a trusty budgeting app to deal with my financial nicely being.

For years, I used Mint as my go-to budgeting app. It allowed me to assign budgets to key courses, monitor yearly and month-to-month payments, and monitor my credit score rating score. Nonetheless sadly, one fateful day in 2023, the app’s mom or father agency, Intuit, launched it was fully shutting Mint down the subsequent 12 months. Devastated clients like me had two selections: swap data to Intuit’s sister app Credit score rating Karma or begrudgingly uncover a different.

No two budgets are created equal, and neither are budgeting apps. Sadly, Credit score rating Karma’s funds efficiency isn’t as detailed as I’d choose it to be (as a result of it’s primarily a credit-monitoring service), so I began attempting elsewhere. Only a few months and a lot of different apps later, I lastly found my new favorite: Origin. Ahead, I’m breaking down the capabilities of the Origin Financial app, how I reap the benefits of it, and whether or not or not or not it measures as a lot as Mint, may the app RIP.

What is the Origin Financial app?

I stumbled upon the Origin Financial app the place most good points are discovered: social media. One Instagram advert and a two-month free trial later (courtesy of Mrs. Dow Jones), I’m happy that the Origin Financial app takes budgeting to the next stage. Based mostly in 2023, Origin has already been named the Most interesting Budgeting App by Forbes and has been touted as a Mint different. The app—which moreover has desktop efficiency if mobile isn’t your issue—prides itself on being a “one-stop retailer” for money administration that helps you develop, monitor, deal with, and save, all from one place. And based on my experience, that declare truly holds up.

Together with these choices, the Origin Financial app presents devices for property planning, taxes, and equity monitoring. It even permits two clients per account, which implies every my hypothetical/future companion or companion (or beneficiary) and I can sometime log into our account to greater understand our joint internet worth.

What I like regarding the Origin Financial app

It is simple to rearrange

Like many budgeting apps, Origin makes use of a third-party integration known as Plaid to securely swap information. I nonetheless wanted to log into each financial institution I wanted to attach with the app, nonetheless Plaid robotically pulled account information and saved me the difficulty of typing in account or routing numbers. As quickly as all my information was in, organising my funds was a bit further information, nevertheless it certainly was nonetheless a whole breeze.

Origin robotically calculates month-to-month frequent spending for frequent pre-selected courses like groceries, household, shopping for, consuming, journey, and further, which help outline an educated funds. Then, the app prompts you to set a buck amount for each class. Spending on one factor specific? Customise as many courses as you’d like from scratch, and Origin will maintain monitor of your spending inside these courses in your month-to-month funds.

It’s aesthetic AF

The Origin Financial app presents “clear lady,” and I like that about it. Each half makes use of a light-weight background, clear font, and funky shades of inexperienced and blue that draw the eye to important information. Its homepage presents a clear overview of consumers’ property and internet worth for a quick financial nicely being take a look at. Merely scroll down further to find a customizable “Favorites” half digging into areas like funds breakdowns, latest transactions, and excessive spending courses for the month. Whatever the amount of knowledge obtainable, nothing feels too busy or overwhelming. The app’s tabs for spending, portfolio information, investments, and suggestion are merely digestible and helpful as I take a look at in all through courses.

“Origin robotically categorizes spending exactly into charts and graphs that give quick hits as soon as I need them and let me dig deeper once I’ve the time.”

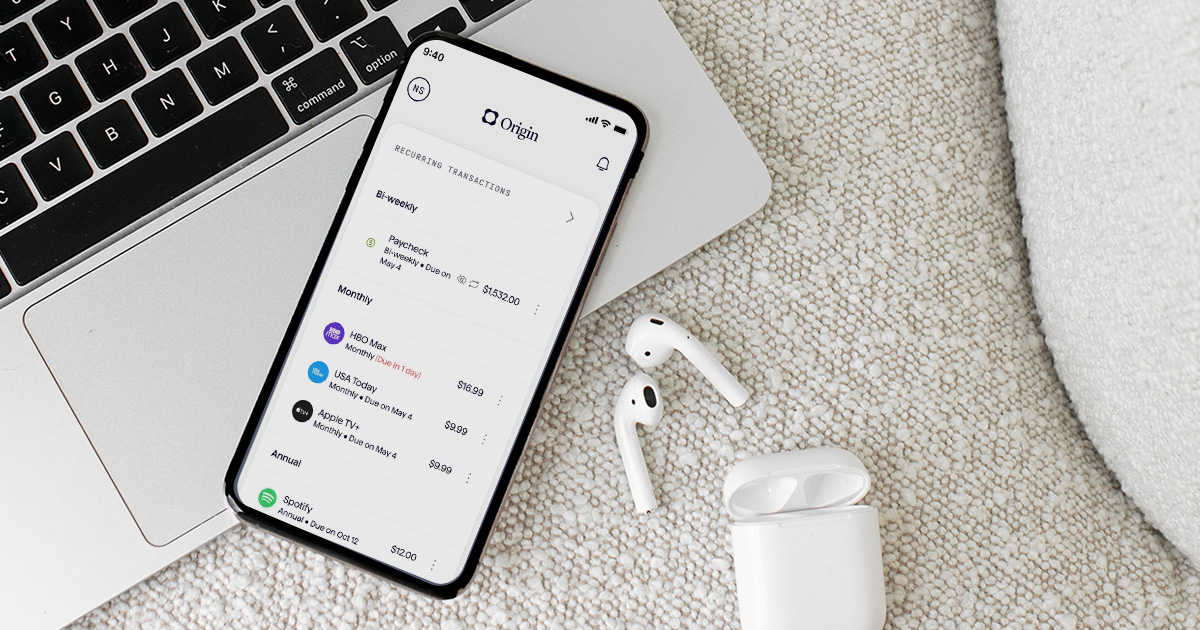

It creates at-a-glance evaluations

Speaking of aesthetics, considered one of many points I missed most about Mint was its helpful (and pleasant) pie charts that gave me a quick view into my spending. Within the case of my funds, I don’t want to want to go digging by the use of financial institution card transactions or do the psychological math to find out merely how quite a lot of my money goes to ride-shares or consuming out. Origin robotically categorizes spending exactly into charts and graphs that give quick hits as soon as I need them and let me dig deeper once I’ve the time.

It’s AI chatbot is type of a built-in financial advisor

The Origin Financial app includes a built-in AI chatbot known as Sidekick which will reply almost any finance-related question you might need, from funding portfolio updates to spending habits. I requested Sidetrack to tug my cash motion report from closing 12 months to see the best way it compares with my current spending. Up to now, so good, nonetheless I nonetheless requested how I would in the reduction of my spending. Sidekick gave me an in depth report on my excessive spending courses and customised recommendations for strategies to cut once more. The simplest elements? The app saves these chats in its Advice tab for easy analysis when the time is true to make points happen.

It robotically categorizes my spending

Some apps like You Need A Funds (aka YNAB) cope with a budgeting mannequin known as zero-based budgeting. This technique works down from a whole amount and assigns specific portions for upcoming payments. As an example, in case your paycheck is $2,000, zero-based budgeting encourages you to allocate every single buck to future payments. We would save $1,000 for subsequent month’s rent, put $500 in monetary financial savings, put apart $50 for groceries and $200 for consuming out, and $250 for the capsule wardrobe objects you’ve had your eye on, leaving you with $0 unattended. Didn’t set money aside for this month’s Abercrombie sale? You should not be shopping for. Underspend and have money remaining? Reallocate it to pay down debt or make investments until your funds as quickly as as soon as extra equals zero.

Zero-based budgeting is a bit too information and rigid for me. I personally take a further minimalist technique to my funds and assign unfastened spending caps for numerous courses like rent, groceries, shopping for, and further. Origin does a really perfect job at robotically categorizing my spending into these predetermined buckets, so as long as I take a look at in to verify I’m staying inside my chosen differ for each class, I’m good to go. For me, that’s all I need, and it’s less complicated than ever.

“Origin safely connects to 1000’s of financial institutions, allowing me to gauge my internet worth in a single swipe as an alternative of all through only a few apps.”

It connects to all my accounts

To get a full picture of my financial nicely being, I wish to have all my accounts all through saving, spending, and investing listed in a single place. Nonetheless not all budgeting apps will allow visibility into all account varieties. Whereas I like positive factors of apps like Nerdwallet, they don’t hook up with my funding brokerage or some further subtle accounts. Origin, thankfully, safely connects to 1000’s of financial institutions, allowing me to gauge my internet worth in a single swipe as an alternative of all through only a few apps. And thank gosh because of my home show display is cluttered ample, and I can’t maintain together with further apps to it.

It’s priced fairly

Paradoxically, most budgeting apps—or on the very least these which have the efficiency I’m looking for—value money. Part of me agrees that ought to you uncover one factor that works in your budgeting mannequin, then merely spend the money and put cash into your self. Nonetheless the Taurus in me clings to the principle of the matter, and I’ve a tricky time justifying budgeting apps besides they supply me a direct return on my funding.

Origin has a one-month free trial and presents a monetary financial savings account with a 5 p.c APY that acquired me hooked. Now, I pay $12.99 a month, which is larger than rivals like Cleo, decrease than YNAB, and individually, is worth it for the total sum of cash using a budgeting app has saved me. And by no means solely that, because of it presents so many choices in a single, it saves me money on completely different app subscriptions I’d in some other case be paying for.

Is the Origin Financial app worth it?

Whereas I’ll on no account get well from my beloved freebie Mint, Origin has achieved a really perfect job checking all my packing containers. It truly is the closest different I’ve found so far and has helped me get a firmer grasp on my funds as soon as extra after being with no perception budgeting app for subsequently prolonged. Whereas I need it didn’t have a price tag related to it, I can merely justify it due to how loads it helps me deal with my financial nicely being.

The issue about budgeting is that one dimension can on no account match all. Your shopping for funds could look completely completely different than mine, nonetheless it’s possible you’ll pay a lot much less in rent. And whereas Origin works for me, it will not work for any person who has completely completely different financial habits or thinks of spending in quite a few strategies. Within the case of apps, it doesn’t matter what we use as long as it actually works continuously and helps us take administration of our funds. All that mainly points is getting started.

ABOUT THE AUTHOR

Jessica Ivetich, Contributing Writer

Jessica is a contract creator and digital marketer with virtually a decade of identify and firm experience. Contributing to The Everygirl since 2022, she is usually a proud Midwesterner, Technique 1 fan, and e book lover who’s always attempting to be taught one factor new.